Lease vs. Loan

Compare the differences between an equipment lease and a loan with our comparison table and make the right equipment acquisition choice for your business.

See full post

By: Don Bulger, Account Manager

Leasing helps equipment dealers sell more equipment, especially in the transportation industry where high equipment costs are a significant investment for customers. Whether you’re still exploring how leasing can help your dealership or you’ve already tallied some financing miles, our four leasing tips will provide options for your customers that may help you close more sales.

Your customers value cash flow. Rather than restrict your transportation equipment to customers who can only afford an upfront payment, make it more affordable through leasing. Financing divides the cost of your equipment over months or years, and equipment is more affordable when you lead with a seasonal or monthly payment rather than the full upfront cost.

Take the following example: a customer wants to buy one of your long haul trailers. He or she approaches you to ask for pricing. The trailer costs $100,000. Which of the following sounds better to your customer?

Option one: “The trailer costs $100,000.”

Option two: “The trailer costs around $1,800 per month if you lease it over five years.”

With the second option, you’re presenting the price in a way that’s easier to conceptualize and more relevant for customers who generally handle their revenue and expenses on a month-to-month or seasonal basis. Keep in mind, payments for your equipment will vary depending on equipment price, interest rate, term length and residual. For the example above, we chose a five-year term with a six per cent rate and a $10,000 residual on a $100,000 trailer.

Financing allows you to offer payment structures that align with your customers’ revenue. This means they’re only paying for your equipment when it’s making them money. Some of your customers may have busier seasons throughout the year. Seasonal payment plans offer the flexibility those customers need to maximize their cash flow year round.

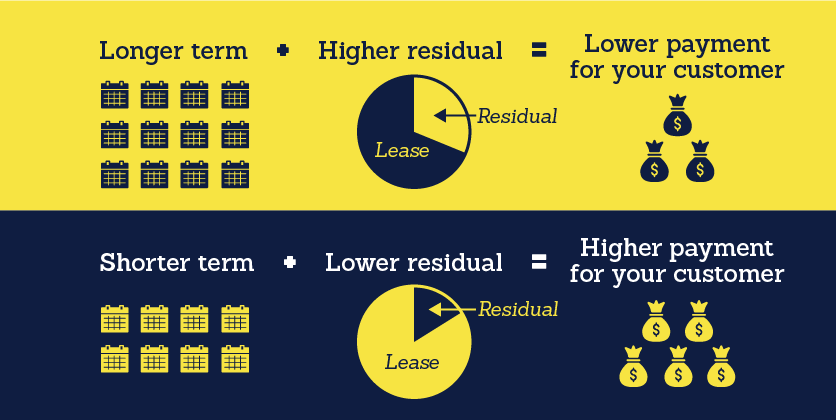

If a customer is looking for maximum flexibility, you can offer a longer term with a higher residual for lower payments. Conversely, if a customer wants to pay off their financing sooner, shorten the term and decrease the residual to increase payments. The residual is the amount your customer pays to the leasing company after the lease term. Different residuals don’t affect your revenue since the leasing company purchases your equipment in full and leases it to your customers.

What you need to remember:

Longer term + Higher residual = Lower payment for your customer

Shorter term + Lower residual = Higher payment for your customer

When you partner with a leasing company, you’ll usually have easier and quicker access to financing than with a bank since lessors generally simplify the process. In CWB National Leasing’s case, our contract is only a couple of pages long and we have an Account Manager and support team dedicated to each dealership.

Let’s say a customer approaches you for equipment they need for their business. They’ve likely already spent hours researching which type of equipment they need. If this customer also needs financing, they’re likely to spend hours more researching a financing company. But with in-house leasing, you’re saving your customer time and actually expediting the sale. It’s a great way to start a customer relationship.

You can also use financing for repeat business. Some lessors will send you regular reports showing which customers are nearing the end of their lease. Reach out to these customers and see if they need an equipment upgrade or need to expand their fleet.

Whether you’re leading with a monthly or seasonal payment, customizing payments to meet your customers’ needs or mining existing customers for a repeat sale, leasing is a tool that will help you sell more equipment.

After all, the right tool makes any job easier.

Posted in Equipment leasing advice,

Contact us and we'll call you right away