Lease vs. Loan

Compare the differences between an equipment lease and a loan with our comparison table and make the right equipment acquisition choice for your business.

See full post

By: Mark Roach, General Manager, Atlantic Canada

You’ve determined which logging equipment will yield the greatest return on investment, which model is best for your needs and which brand has the most positive reviews. You’re ready to get the equipment and you’re onto the second phase of research: how you'll you get it.

You can either purchase or finance. Purchasing will provide instant ownership but requires a significant upfront cash outlay. Financing, whether through a lease or loan, provides many advantages which we explore below.

Forestry and logging equipment take a beating. The average lifespan of forestry equipment lasts from 12,000-20,000 hours. To put that in perspective, construction equipment lasts on average 34 per cent longer than forestry equipment. Although some repairs on forestry equipment are inevitable, the frequency of repair increases as equipment ages, which chews into your productivity and profits. New equipment will cut down on repairs and increase efficiency. Financing that equipment will keep cash flow available for additional equipment upgrades and increase efficiency further.

See how one forestry company increased profits by financing new equipment.

Most companies finance to ease cash flow pressure from equipment acquisitions, and rightly so. Forestry equipment isn’t cheap. A new feller buncher can cost anywhere from $300,000-$600,000. Financing that cost over four or five years eases the impact of that equipment cost. In CWB National Leasing’s case, we reduce the impact further, offering financing terms up to six years.

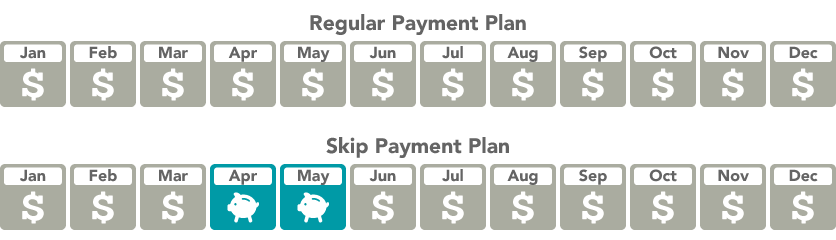

Seasonal factors influence the forestry industry differently across Canada. Although B.C. usually experiences mild winters, the Atlantic Provinces experience heavy snowfall and soggy springs that require road closures. Because production naturally slows during these periods, it makes sense to structure your equipment payments accordingly. With skip payments, you won’t pay during those seasonal lulls; instead, you’ll spread your annual cost over remaining payments, saving money when business is slow.

Not every company can afford new equipment upgrades every few years. The next best option: used equipment. Financing used equipment provides all the benefits of financing new but for more affordable payments. Financing companies may have different criteria for judging each piece of used equipment. At CWB National Leasing, we’ll finance used equipment up to six years old.

If you’re an Atlantic Canada logger, the Atlantic Investment Tax Credit is a huge incentive. The tax credit is a 10 per cent government rebate when you acquire forestry equipment in Newfoundland and Labrador, Prince Edward Island, New Brunswick, Nova Scotia or the Gaspe Peninsula. Your finance company should pass on the rebate to you. For example, if you finance with CWB National Leasing, we’ll reduce your principal by 10 per cent.

Learn more about the Atlantic Investment Tax Credit and its financing implications.

Imagine your business’s finances are like a forest. Buying equipment is like clearing the entire forest without reforestation. You continue logging, hoping to find new forests that keep business steady. It’s risky. Financing equipment is like logging sustainably. You clear forests but practice proper silviculture and reforestation. Your forests regrow, sustaining your business over the long term and reducing risk.

Posted in Equipment leasing advice,

Contact us and we'll call you right away