Lease vs. Loan

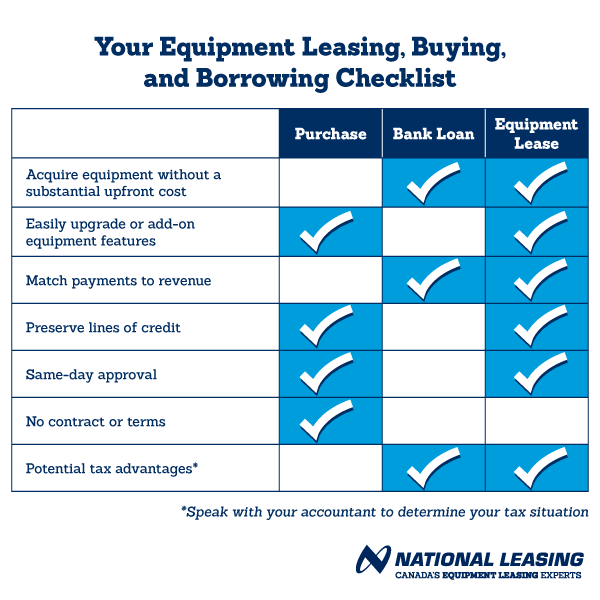

Compare the differences between an equipment lease and a loan with our comparison table and make the right equipment acquisition choice for your business.

See full post

By: Ken Canavan, Account Manager

After all, your choice will affect your cash flow, line of credit and future equipment upgrade needs.

Rather than darting from online financial resource to resource, we’ve created a checklist to help weigh your acquisition options so you can choose the best option that matches your financing needs.

Buying is simple and will preserve lines of credit but requires a substantial upfront investment that may empty your cash reserves. A bank loan solves your cash flow issue but affects your line of credit, has a lengthy approval process, and its contract terms may limit your opportunity to include equipment add-ons or upgrades in the future. With equipment leasing, you’ll match payments to your revenue cycle (you even have an option to delay payments on your equipment), preserve lines of credit, and easily upgrade your equipment once your lease is finished.

Whichever option you choose, make sure it aligns with your business goals and helps grow your business.

To learn more about leasing, check out our Complete Guide to Equipment Leasing.

If you’d like to lease your next piece of equipment, fill out the form below to get a free quote.

Posted in Equipment leasing advice,

Contact us and we'll call you right away