Enabling a culture of innovation

Find out how CWB National Leasing empowers employees to share ideas and innovate.

See full post

By: Janice Boulet, Vice-president, Credit

Establishing good credit early on, both personally and for your business, is integral to getting approved for a line of credit, loan or lease with any finance company.

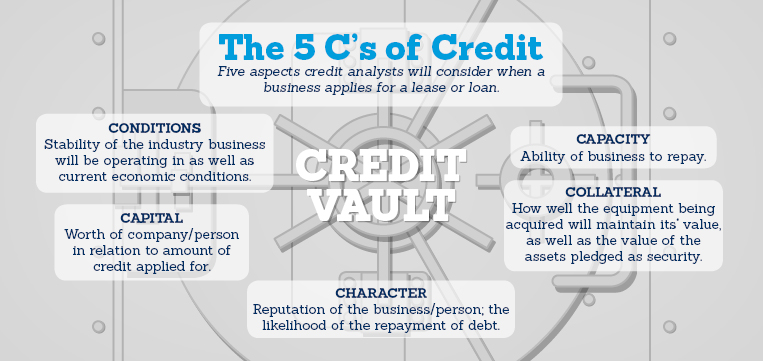

As part of CWB National Leasing’s month-long series to celebrate Canadian Small Business, I’m breaking open our credit vault and telling you how to establish good credit and keep it that way, so the next time you go to a lender, you’ll be seeing dollar signs.

If you are a new business owner, be prepared for credit analysts to look at your personal credit history, as this is a reflection of how you would manage your business's finances. How you repay your credit cards, loans, lines of credit or leases all contribute to the development of your credit history.

Equifax and TransUnion are credit bureau agencies that track everyone’s credit. For a nominal fee you can request a credit report from them and see exactly what a credit analyst would see, along with your credit score. This is also a great way to prevent identity theft. If someone has taken out credit in your name you will be able to see this, you can file a fraud claim with the agency and once proven, it can be erased from your credit report. If you have lost your ID, been a victim of fraud in the past, or have reason to be concerned about fraud, you can set up an alert with TransUnion or Equifax. Anytime a request for credit is made in your name, the alert will appear on your personal credit report, which may trigger the creditor to contact you to verify the request.

Paying your bills on time demonstrates you are capable of repaying debt in a responsible manner. This goes a long way in the eyes of a credit analyst.

Do you have a business plan? A financial plan can act as your road map to a strong financial position to help grow your business and not over-extend your debt load.

Understand the terms of your contract, the payment due dates, your payment methods and the flexibilities with each contract. Be proactive and contact your creditor should you not be able to meet your obligation.

Credit analysts will attempt to validate the business’s reputation through on-line resources such as the Better Business Bureau or other internet review sites. Even customer complaints can be a red flag to do more research, treat people right and have a positive reputation

Whether it’s your accountant, a colleague within a business association, or a trusted advisor; have someone you can go to for financial advice and who can mentor you along your road to financial and business success.

Posted in General business advice,

Contact us and we'll call you right away