Enabling a culture of innovation

Find out how CWB National Leasing empowers employees to share ideas and innovate.

See full post

By: Matthew Bedard, Digital Marketing Specialist

Sitting at 73 cents (as of Feb. 4, 2016), the loonie has rebounded slightly over the last few weeks. However, earlier in January the dollar sunk below 70 cents, the lowest level seen in over a decade. What does this all mean for your business? Let’s look back to 2002, when our dollar dipped below 62 cents, for some perspective.

The Canadian dollar’s recent struggles aren’t unprecedented. For a four-year stretch between 1998 and 2002, Canada’s dollar was worth, on average, 68 cents. And while economic conditions aren’t exactly the same now as they were then, we can glean information to help us better prepare for what might happen now that Canada’s dollar is once again under pressure.

One important thing to note: a weaker Canadian dollar does not mean Canada will fall into a recession and drag the overall economy downward. While many countries experienced a recession in the early 2000s, Canada left the period relatively unscathed, experiencing roughly four per cent annual gross domestic product (GDP) growth from 1998-2003, backed in part by strong manufacturing exports to the U.S.

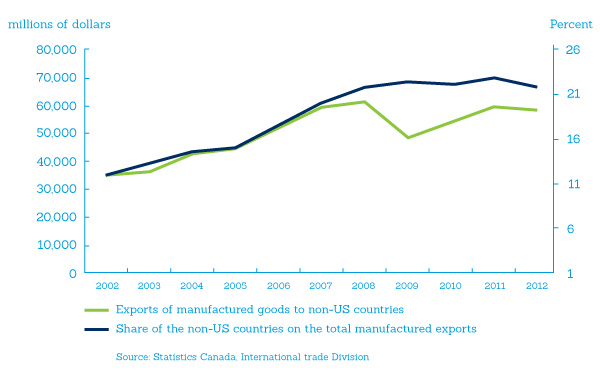

Other countries also increased their purchases of Canadian manufactured exports in the 2000s, at least until the global recession hit in 2008.

Overall, the economy is a complex combination of many factors, and predicting its success is difficult; however, today’s cheaper Canadian dollar may be favourable for certain industries.

As Canada’s dollar value decreases, manufacturers become optimistic, especially those who primarily sell to the U.S. Why? A devalued Canadian dollar means our products and services cost less for our neighbours to the south. We essentially are “on sale”, and using history as our measuring stick, sectors like manufacturing should see a boost from increased orders from the U.S., like it did 15 years ago.

The U.S. makes up a huge chunk of Canadian exports each year. In 2009, in the midst of the global recession, the U.S accounted for 73 per cent of all Canadian exports. As recently as 2014, this figure sat at 75 per cent, highlighting a healthy increase over the last five years. But that doesn’t tell the whole story. Over that same five-year period, Canadian exports increased 44 per cent because the U.S. nearly doubled its Canadian imports. The upward trend appears to have support given the current exchange rate as well as the economic recovery that the U.S. has experienced the last couple of years.

The main takeaway: a weak Canadian dollar and a strong U.S. economy could mean increased demand for Canadian manufacturs that produce equipment or parts and supplies for industries like agriculture, transportation and forestry.

A lower dollar may also increase domestic demand. While Canadian goods are cheaper to our southern neighbours, U.S. goods are more expensive. Rather than import equipment or parts, Canadian businesses may purchase domestically, further boosting the manufacturing sector.

Low oil prices still hamper the oil industry. But as oil producers curtail production, supply will eventually drop; crude pricing will stabilize and should even increase. If and when this unfolds, our dollar will also stabilize and likely increase relative to the U.S. dollar. However, current market expectations don’t see this as a near-term event, especially in the next few quarters.

Read how your business can still take advantage of low oil prices through equipment leasing.

If your company exports to the U.S., now may be the time to invest in equipment that will help ramp up production. How you choose to acquire that equipment will determine your company’s flexibility going forward. Financing will keep capital available for other opportunities. You can also tailor term length and payments to match your revenue cycles.

Buying and bank loans are two other choices. Each has benefits. See which acquisition option is best for your business with our handy checklist.

A lower loonie will affect each industry differently. If you’re a manufacturer who relies on exporting to the U.S., this could be your opportunity. Evaluate your equipment acquisition options so you can get the equipment to increase production, while staying financially flexible for other opportunities.

Posted in General business advice,

Contact us and we'll call you right away