Enabling a culture of innovation

Find out how CWB National Leasing empowers employees to share ideas and innovate.

See full post

By: Bernadette Danyluk, Manager, Small-ticket Credit

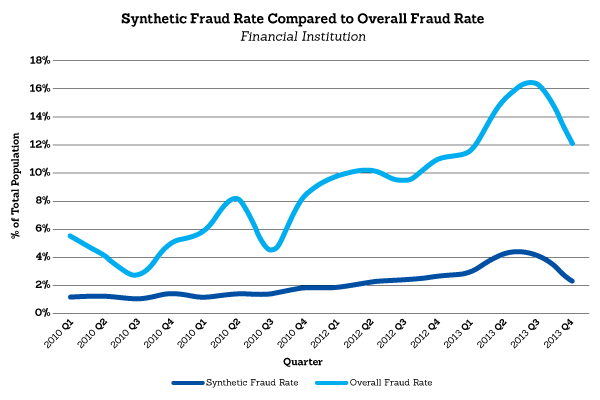

Synthetic fraud is like a souped-up version of identity theft. It’s near-impossible to detect, and it’s pilfering money from Canadian businesses at astonishing rates. One CBC article reports potential loses around $1 billion annually. More worrisome: the rate of synthetic fraud more than doubled since 2010.

Graph from ID Analytics

It can take months or years before a fraudster commits synthetic fraud and the scheme generally works like this: using a fictitious name, synthetic fraudsters manage to secure some form of official government document, usually a driver’s license. Then, they apply for credit cards until they obtain one. Rather than run up their balances and skip on these small credit facilities, fraudsters will use the credit card to make regular payments to build up their credit rating under the fictitious name. Eventually, the fraudster will use their false identity to score large personal or business loans that they never plan to pay back.

With most identity theft cases, fraudsters steal someone’s secure information and pose as that person for some financial gain until the victim or credit agency notices a purchasing discrepancy. With synthetic fraud, a fraudster creates an identity.

You know those scenes in spy movies when the spy opens a briefcase filled with passports that have different identities from different countries? It’s the same idea with synthetic fraud, minus the international espionage and extravagant action sequences.

Financial institutions struggle to detect synthetic fraud since they have no way of knowing an identity is fictitious thanks to the supported government documentation. Police are equally confounded. Synthetic fraudsters usually create multiple fake identities, shuffling finances around and using different addresses that stymie paper trail investigations.

Authorities and organizations are taking steps to fight the crime. Facial recognition software allows police to detect faces that appear on multiple official documents, and organizations like Equifax and TransUnion have their own propriety technology.

To protect your business, keep an eye out for any suspicious transactions. If your company has already been victim to synthetic fraud, notify the police and perform your own investigation. Synthetic fraud is difficult to detect, but information from past cases may help save you money in the future.

You can also protect your business from more common types of fraud with our 8 Tips to Protect Your Business from Fraud article.

Posted in General business advice,

Contact us and we'll call you right away