The Canadian farming landscape is changing. Industry data and one farmer’s experience will teach you how to adapt, utilize trends and bolster your farm’s profits.

Meet Jim Leslie, successful Portage La Prairie farmer who has been in the agriculture game his entire life.

Jim’s farming story is similar to aspirations of betterment parents have for their kids. He inherited the family farm from his father and grew it into a larger, higher-yield enterprise. Jim has been successful for two reasons: he has adapted and taken advantage of recent farming trends.

He cycles his oilseed and grain production to account for crop tendencies and utilizes new technology to create a more efficient and higher revenue-generating farm. And by examining the Canadian agriculture industry, we’ll see that Jim’s approach is the right one.

According to the 2011 Census of Agriculture, the number of Canadians farms decreased by 10 per cent since 2006; however, the size of farms – average acreage and farms earning greater than $500,000 in Gross Farm Receipts – is increasing, especially on the prairies.

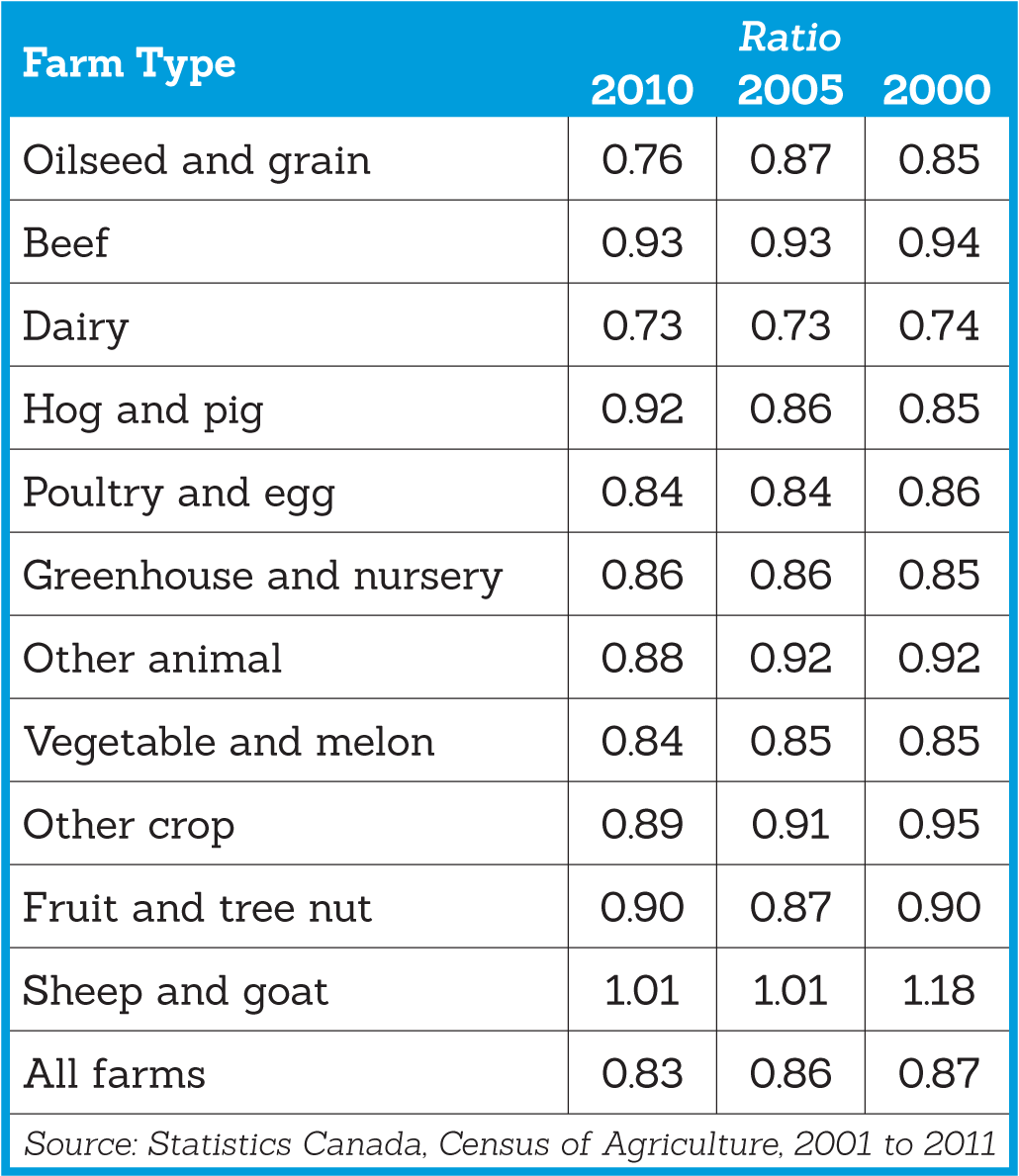

Farmers are effectively squeezing more revenue from their crops. During a 10-year period (2000-2010), average ratio of expenses to receipts – the cost spent for every dollar earned – decreased nationwide from 0.87 to 0.83, meaning for $1 earned, farmers spent 83 cents.

From that info, we glean what makes the successful Canadian prairie farmer: larger acreage farms that gross high revenues – more than $500,000 – with a focus on cutting costs through innovative process improvements.

That’s all great and interesting, and of course, every farmer wants to be a successful one, but how are they making the jump from a small farming enterprise to a high-grossing operation? Learning from Jim and two handy reports on Canadian farming trends – one from the George Morris Centre and the other from the Conference Board of Canada 1 – I’ve determined four ways prairie farmers can vault into the next earning bracket. Keep in mind, although this list will help guide you through farming issues on the macro level, each farm requires specific adjustments to operate optimally.

1. Produce the right crops

Certain crops are more profitable than others. Let’s dig a little deeper into the expense-to-receipts ratio mentioned above and see which type of farms earn the highest profits, on average.

Dairy, oilseed and grain farms rake in the highest profits while sheep and goat farms are actually losing money. That’s not to say that every dairy, oilseed and grain farm is profitable or every sheep and goat farm is in the red, but generally, don’t start a sheep and goat farm and expect to make huge profits.

Many things contribute to these ratios, including crop yields/market condition, input prices and technology. Those factors can make or break any farming operation each year. Developing a dynamic risk-management system will help mitigate adverse market conditions, crop yields and input prices.

2. Manage your farm effectively

Although crop type is important, managerial strategy is a farmer’s competitive advantage, and the farming industry knows it. The Conference Board of Canada found that Canadians farmers consider better marketing and lower operating costs as they’re top priorities. Savvy farmers must think creatively to achieve both, and the ones who do, are often the ones who profit.

Better marketing

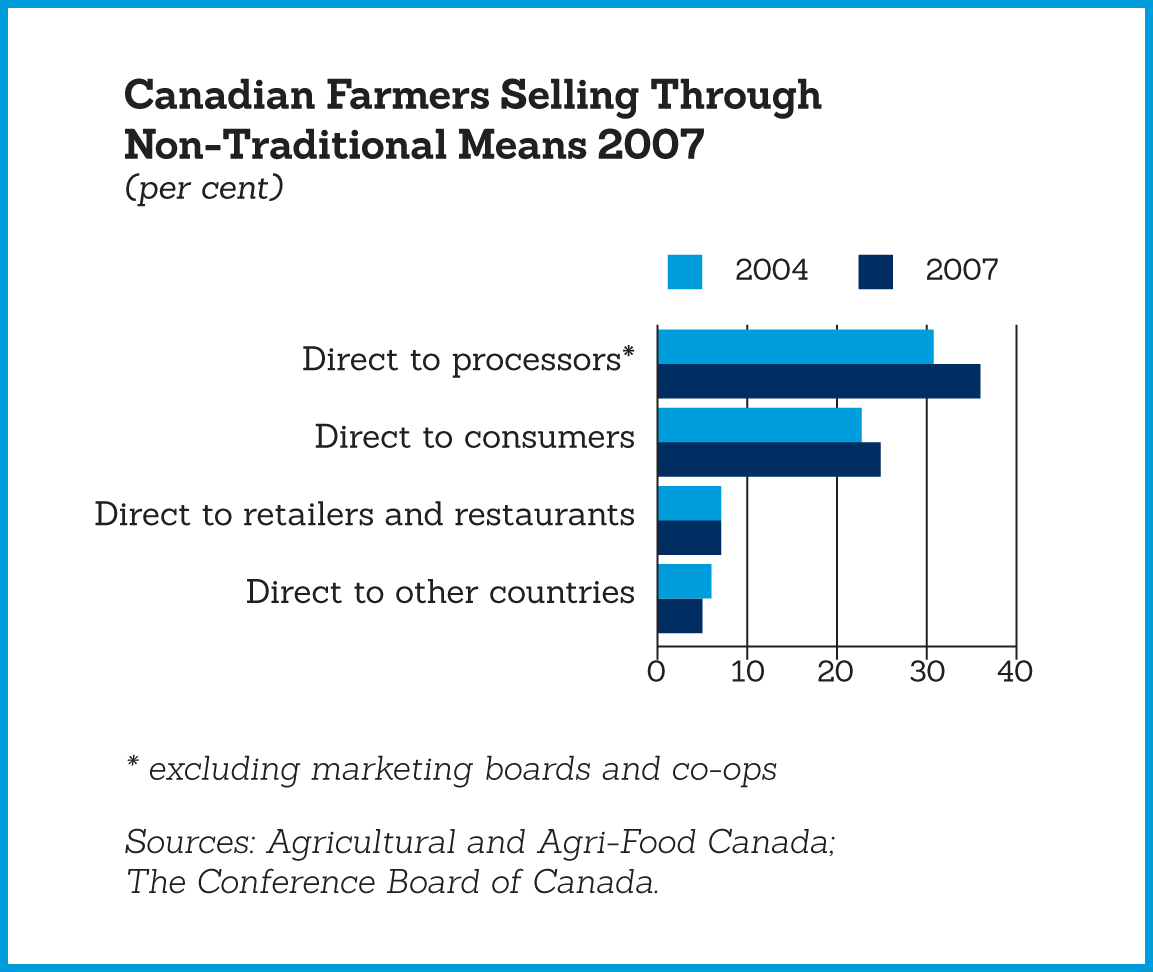

Traditional forms of marketing (marketing board or wheat pool) aren’t dead, but they don’t have the same ageless vitality of past decades. Prairie farmers are no longer only producers. They’re now marketers, too. And to maximize profits, they must determine a more consumer-driven marketing strategy that will answer some important questions. Mainly, without a marketing board, how will they find buyers? And how will they determine pricing?

Direct-buyer selling and sales market diversification combine to create one solution. Utilizing forward contracting is another. With direct-buyer diversification selling, farmers seek out their own buyers. They sidestep auction markets and marketing boards, pocketing money usually reserved for fees. It’s a fairly recent trend that’s allowed farmers to maximize revenues.

With forward contracting, otherwise known as futures or direct marketing, farmers work with buyers to lock in an agreed upon sale price before harvest hits the market. Commodity exchanges – similar to the stock market – help determine prices.

The good: futures help mitigate risk in volatile markets and lock in high profits farmers strike agreements during peak price periods. The bad: future prices may end up lower than market value, decreasing profits.

Lowering operating costs

Farmers can’t control input prices, but they can choose how those prices affect their balance sheets. As an example, let’s take one of the most – if not the most – important input to a farmer’s success: land.

Jumping into that next revenue class on the prairies requires expansion, but land availability is dwindling while demand and price increase. And despite the investment advantages of ownership, accumulating debt can cripple any operation. The solution – farmers are increasingly renting or leasing more land. From 2006 to 2011, land rented by Canadian farmers increased by 10 per cent, while land ownership decreased by six per cent.

Although those numbers aren’t staggering, the land price example illustrates an important point: as the trend to bigger acreage farms across Canada increases, farmers must manage their inputs creatively to combat rising prices.

3. Adopt technology and have the right equipment

This one is pretty simple. Larger equipment and innovations – auto-steer technology, GPS and mechanical harvesters – increase productivity. In other words, farmers can do more with less, reeling in costs along the way.

Farmers who have the right equipment will also better utilize crop trends. The record-setting 2013 grain bumper crop is a great example. With Canadian (and to a lesser extent, worldwide) grain production reaching new heights in 2013, the market was oversaturated, creating a grain surplus and lowering prices. Without additional grain storage to preserve the harvest and save it for a more profitable season, grain spoiled.

Sometimes having the right equipment is luck. Most times, it’s noticing trends and crop conditions and then planning ahead.

4. Utilize economies of scale and high purchasing power

Okay, bear with me while I run you through a quick economics lesson.

Businesses – or in this case, farms – decrease their cost per unit as they increase in size because of what’s called economies of scale, or put another way, purchasing power. Let’s run through two examples and better illustrate the concept.

Low purchasing power

You’re on a tight grocery budget this week, with only $16 to spend, but you need four chicken pieces for a dinner you planned. You visit your local grocer and buy four pieces of chicken for $16. You grumble about the ridiculous cost of chicken – you just spent $4 on each piece – but make the purchase anyway because you must. With low purchasing power, your unit costs are high.

High purchasing power

You earned a raise at work the next week and have $40 for a grocery budget. You decide to cook the same dinner as last week. Armed with more money, you head to a bulk food store and buy 20 chicken pieces for $40. That’s plenty of chicken, and you only spent $2 per piece. Sure, you only need four pieces of chicken for the meal, but you freeze the rest for dinners to come. By spending more money up front, you cut your long-term costs in half ($4 per chicken piece at the local grocer, $2 per chicken piece at the bulk food store). With high purchasing power, your unit costs are low.

Now, imagine this theory in an agricultural context. Larger farms purchase crop inputs in bulk because they can afford spending more right now to save money down the road, while those smaller farms can’t. The important takeaway: when farms get bigger, their costs per unit decreases, potentially increasing their profits.

Purchasing the right equipment and buying in bulk requires significant capital – capital farmers may not have on hand. Similar to how alternative financing options – renting, loaning or leasing – are a solution to increasing land capital costs, they can also help here. Each option has its own advantages.

The Canadian agriculture market is ever-changing, and prairie farmers must adapt to keep their farms successful. Farmers like Jim are industry leaders because they recognize trends and tailor solutions for their farms.

Contact CWB National Leasing and learn how leasing will help grow your agriculture business.

1 Although the Conference Board of Canada’s Seeds for Success: Enhancing Canada’s Farming Enterprising found that the “sweet spot” for farm profitability is within the $250,000 - $499,999 range, the report also found that larger revenue farms are accounting for an increasing percentage of the top profitability groups.

- Share

← Previous Story

Next Story →

Financing made easy.

Contact us and we'll call you right away